There are a few ways to keep an eye on your credit score for free, every month. It’s a good idea to monitor and measure your score over time, and using the free options I’m about to show you, there’s no reason not to.

Three primary companies maintain their own Credit Report about your credit trustworthiness. This report contains a ton of information, such as your past residences, loans and contracts such as phone bills, and of course, credit card records detailed with your utilization and repayment schedule for every month.

The three primary credit bureaus are Equifax, TransUnion, and Experian. Each maintains their own report on you, and a related Credit Score, which is a representation of your credit history. You are entitled to receive a free credit report from each agency once per year. Credit Scores on the other hand, are much more accessible.

AnnualCreditReport.com is the federally-approved portal to receive your credit reports for free.

Credit Scores range between 300 and 850, with a score > 700 considered good. Having a higher credit score provides more options for you – higher credit limits, better credit cards, and better rates when taking out loans.

Credit Scores can be accessed on a monthly basis through a variety of services. One of the best is Mint, a financial tracker which takes all the information from your bank accounts, credit cards, trading accounts, and more and aggregates them in a central place with pretty graphs to keep tabs on your progress.

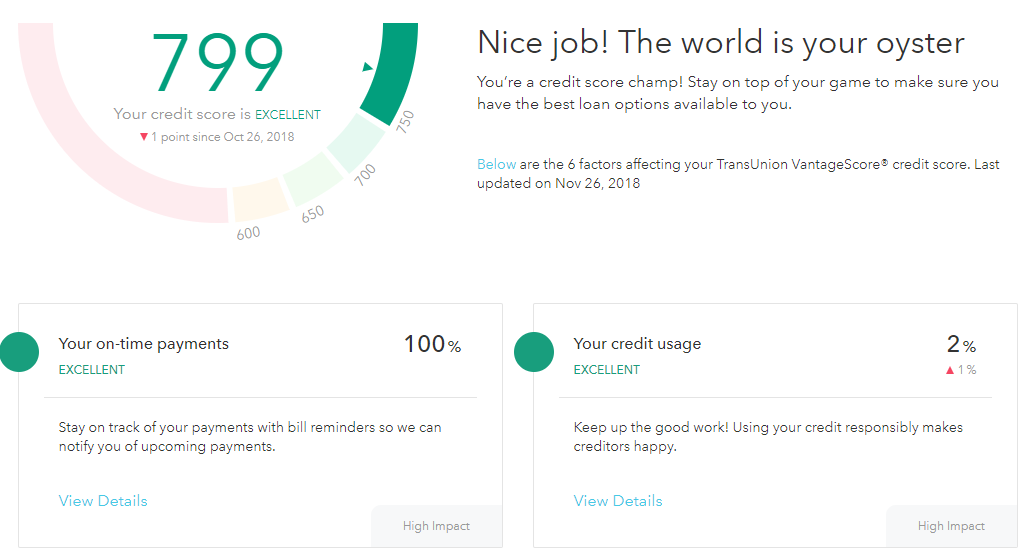

Mint’s free service offers a peek at your TransUnion credit score every month, along with a glimpse of some higher-level details of your credit report. It looks a little something like this:

Mint hints towards the most critical factors that contribute to your credit score, but let me break them down exactly.

The standard FICO scoring system is comprised of the following five factors:

- Payment History accounts for the majority of your score, comprising 35%

- Amount Owed is the next large factor, at 30%

- Length of Credit History is 15%

- New Credit – Avoid opening too many new accounts at once – 10%

- Credit Mix – Different types of credit, such as loans and credit cards, account for 10%

Mint even goes a step further than most and shows you a summary of the categories, with a ranking indicator. As you can see below, I’ve been building credit for 3.8 yrs, which ranks Moderate.

You can get access to your credit score from a number of sources, and another good one is from credit cards. Some credit cards offer access to your credit score as part of their service. However, like all good free perks, it can be hard to find sometimes. First, make sure your card offers free credit score checking. Then, look for access to it on your account page. At Citi, the credit score link blends in:

Of course, another great feature of credit cards is earning points and cashback. The Citi Double Rewards card essentially offers 2% cashback on every purchase – but do you know how to stack cashback?

Building and maintaining credit is simple in theory, just pay things off on time and keep a low balance, right? Well, if it were easy there wouldn’t be a ranking system to decide how trustworthy a potential lendee is. Life gets in the way, and we’ve got a few tips to help you maintain that positive score even should the unexpected occur.

One of the best things you can do for your financial and emotional well being, and for your credit score, is to build an emergency fund. An emergency fund can help cover unexpected expenses, so your on-time payment history or outstanding balance doesn’t take a negative hit.

By the way, if you’re interested in credit scores, emergency funds, and making money, check out our main site: https://www.checkoutsaver.com. We’re inventing new features and techniques all the time to save you the most money possible when you shop. We take a very small % of the money we save you to keep the lights on, so it’s in our best interests to save you the absolute most that we can. Please support our independent business, and we’ll support you on your financial journey too! Thanks for reading, and please leave any comments and feel free to reach out!

Join with Google

Join with Google